Impermanent Loss

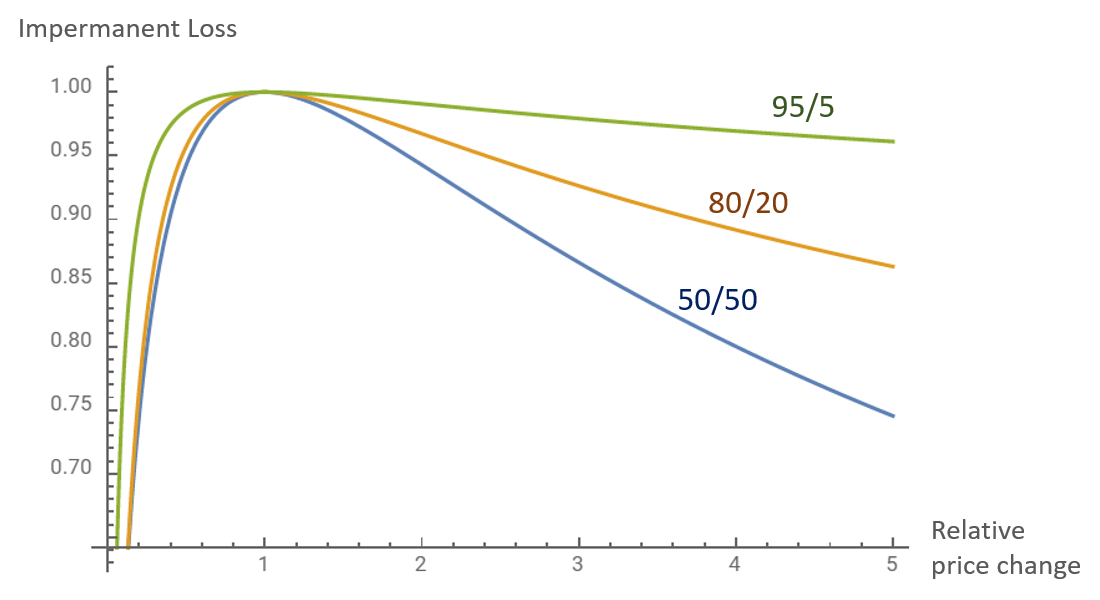

Impermanent Loss, sometimes referred to as divergent loss, can simply be put as the opportunity cost of adding liquidity into an AMM pool vs holding the individual tokens.

Impermanent loss occurs when the prices of two assets experience a divergence in price action. For example if two assets increase by 20% no impermanent loss is noticed; however, if one asset increases in value by 20% then a divergence has taken place and some form of impermanent loss would be noticed in the position. This can be reversed by the other token in the pool also increasing 20% or both tokens converging on the same price movement relative to the original amount the user put in the pool. A basic example of impermanent loss followed by reversal scenario is outlined on the following page.